Digital payments have been a major focus on mobile devices, as mobile users continue to show a preference for mobile digital payments over conventional payment methods. As more mobile device users adopt mobile banking and mobile commerce channels, the need to digitize online payments will become increasingly important.

Comparison of digital payment VS Cash payment

Digital payment is becoming more popular because its faster, easier and convenient. The mobile banking market has grown over the past several years. Consumers are now using mobile devices to pay their bills, transfer money between accounts or send international payments. The mobile payment market will continue to expand as mobile commerce becomes increasingly popular among consumers.

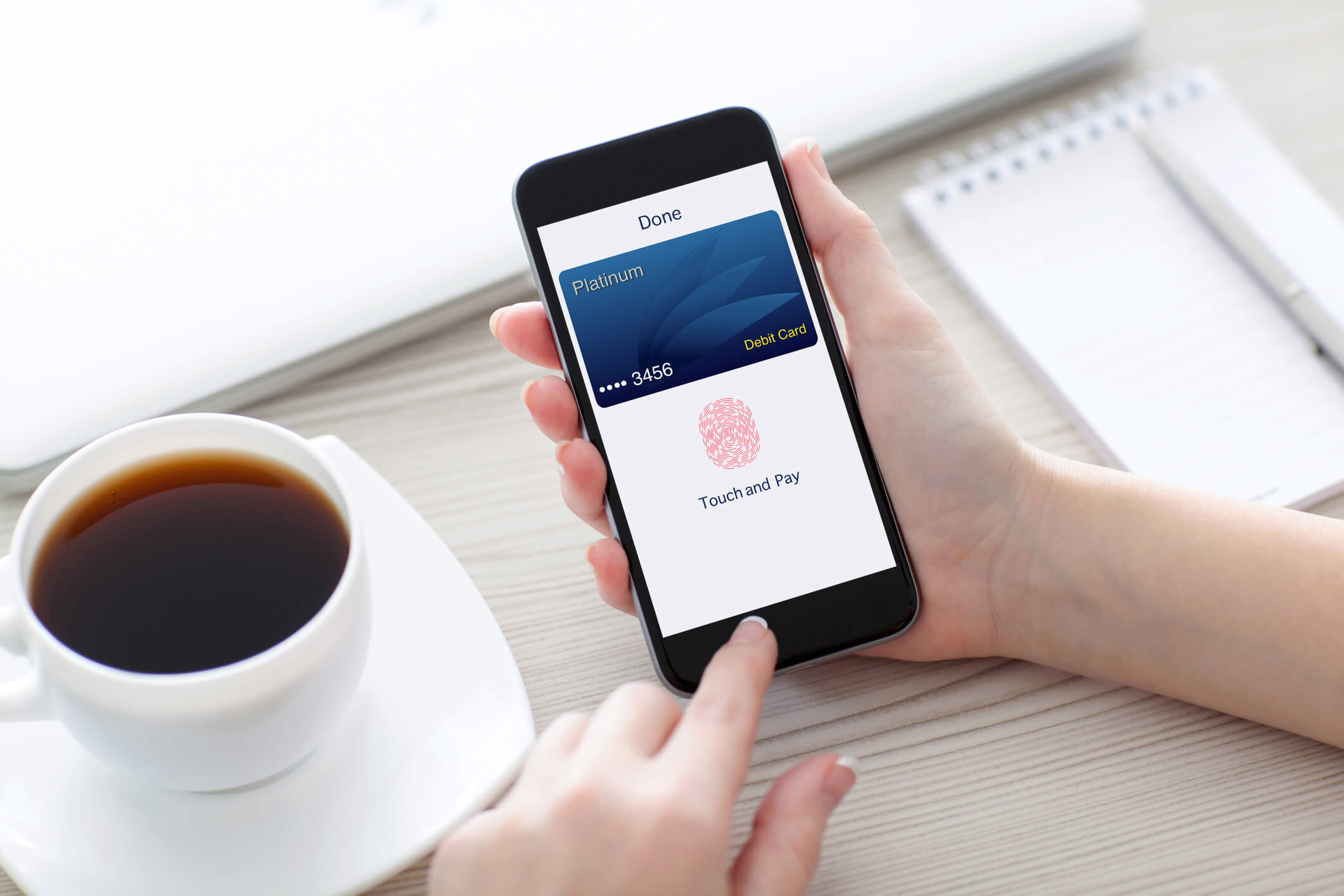

Mobile digital payments allow mobile users to make purchases with mobile applications or mobile websites without having to enter their bank account or credit card details. When mobile users make mobile payments with mobile digital payments, their sensitive financial information is never shared with the merchant. Mobile digital payment apps serve as an intermediary between mobile devices and the online checkout process.

Cash payments, on the other hand, is still being preferred by consumers who do not want mobile payments because it is more flexible. Paying in cash is still preferred because it can be used as an alternative form of payment in cases where mobile devices are not working properly or mobile consumers do not want to use mobile devices.

Why mobile digital payments are the future of payments

In 2016, Business Insider estimated that mobile payment will reach $75 billion in the US. The mobile revolution has been a major catalyst for mobile banking and mobile commerce, as mobile consumers have begun to adopt mobile digital payments at a rapid pace. In 2023, it is estimated mobile payment users will increase to approximately 1.31 billion from 950 million users in 2019.

Mobile digital payments are set to be the future of mobile transactions for both mobile banks and mobile commerce. As mobile device users become increasingly comfortable using mobile digital payments, mobile digital payment apps such as Apple Pay and Google Wallet will expand their presence in mobile banking and mobile commerce over the next several years.

As the mobile commerce market develops further, mobile devices will continue to gain popularity among consumers. This will result in mobile banking and mobile commerce growth, which will increase the need for mobile digital payments.

What do you need to know about Twitter?

How to avoid mobile payment fraud

Since mobile payments are becoming more popular, and mobile devices users should know how to protect themselves from mobile payment fraud. Users must protect their mobile digital payment accounts by using effective passwords and avoiding the use of public Wi-Fi.

Businesses that accept mobile payments also need to take steps to protect mobile transactions through EMV chip card adoption and mobile payment security solutions. The mobile revolution has made mobile payments more popular than ever, and mobile digital payments will become the norm for mobile transactions over the next several years.

Make sure that you did your own research before downloading any app and submitting your personal information to avoid phishing and fraud.